Property rights are conveyed upon the owners of every private property in the USA. There are two types of property rights: surface rights and mineral rights. A property owner may own both or just one. When looking into large land investments, be sure to ask if the real estate has mineral rights.

During the westward movement in the United States, the federal government often transferred land to private ownership to encourage settlement in far-flung areas. The Homestead Acts granted surface and mineral rights up until the early 20th century when the federal government chose to retain mineral rights for homesteads. Now generations later ownership of mineral rights varies substantially from parcel to parcel.

Investing in Mineral Rights

It’s important to know of your complete property rights, especially when weighing the pros and cons of investing in big parcels of land. Mineral rights could pan out someday. We’re not talking about walking around with a Geiger counter but rather developing underground treasure.

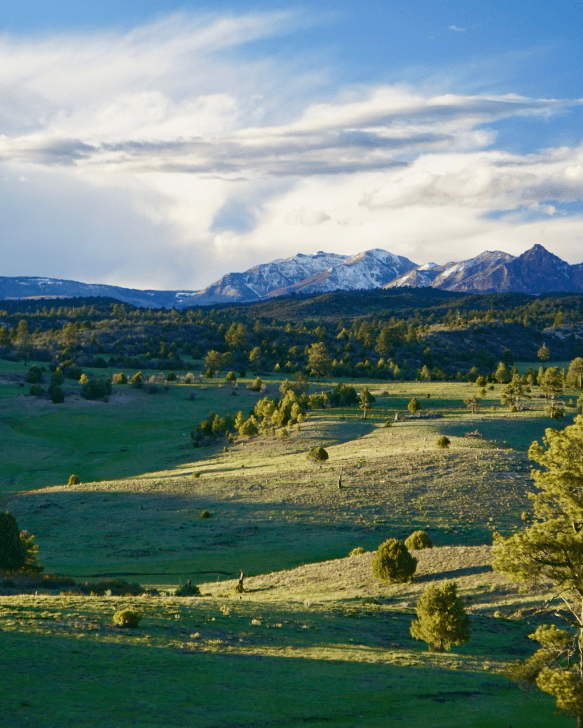

For example, an investment in a Colorado mountain ranch, could eventually lead to gold or silver deposits. After all, miners once panned for silver along the Rio Grande River in Creede, Colorado. Today, hunters and anglers enjoy the beautiful Broadacres Ranch in Creede. (See our Featured Listing.)

Coal, uranium, iron, gypsum, marble, titanium, and tellurium have been mined on Colorado land. Farmer Henry Bakkan drilled for oil and discovered the Bakken formation in Montana and the Dakotas.

How about Butte, Montana, and her legendary copper mines? It’s true that mineral rights have delivered huge monetary returns on investment for a small percentage of farm and ranch owners. Maybe your investments could land you among them.

Knowing the Language

Let’s define a handful of terms used in the discussion of mineral rights. Then we’ll talk about how to figure out whether your property has mineral rights. And we’ll let you discover who owns those rights.

A. Property rights

B. Surface rights

C. Mineral rights

D. Unified estate

E. Severed estate

A. What are property rights? In modern times, investors and large landowners need to be aware of two categories of property rights: surface rights and mineral rights. Large farms and ranches out west may retain all property rights while others do not have mineral rights.

B. What are mineral rights? Mineral rights on land allow the property owners to develop or remove minerals that may be under the surface of specific acreages. Mineral rights on property may include sedentary minerals and fluid minerals. Oil, gas, coal, gold, silver, and copper are most often extracted. Gravel, sand, and water are not sold as minerals.

There are four types of mineral rights: surface rights, mineral interests, royalty rights, and gas and oil rights. To extract the minerals, owners could excavate hard rock, drill for oil or gas, or mine surface coal. The imposition on the property depends on the technology used in what mineral is sought. Surface mining may disrupt shallow but wide sections; oil rigs use a small footprint on the surface but may penetrate a mile into the ground.

C. What are surface rights? If you are investing in farm or ranch land, you may be buying land without mineral rights. A separate person or government agency could own the mineral rights. Landowners normally assume the rights to use the surface of the property. Even if a homestead landowner was given surface and mineral rights, that landowner may have sold one or the other or passed them down to separate heirs.

D. Unified estates are those where the same entity owns both the surface and mineral rights. Look for these terms to describe these ownerships. Unified estate, fee-simple, unified tenure, and fee simple absolute.

E. Severed estates. When different people or entities own the surface and mineral rights, it’s called a severed estate or a split estate.

How to Find Out if your Real Property has Mineral Rights

Look at the deed first to find out if the mineral rights are included. If you are researching to buy a large property in the Rocky Mountains states, you can check the Clerk and Recorder’s office of the county to locate the deed. The county records may offer more clues. However, not all information may be listed on the deed. You might need to go through the historical plat books.

To avoid wasting time or making a mistake, ask your ranch real estate broker to help. The broker may suggest hiring a title company, an attorney, or a professional from an Association of Professional Landmen to assist you in the research. Landmen are experts in the acquisition of a vested share of mineral rights. They also negotiate leases and/or mineral right contracts and perform land inspections.

How are Mineral Rights Passed Down?

Holders of mineral rights may transfer ownership. Deeds for mineral rights may include leases, sales, and gifts. (Agreements such as leases usually have ending dates.) Parents or relatives often pass down the mineral rights. If they are split to multiple family members, it is called fractionalization ownership.

Value of Mineral Rights on Property

Landowners may choose to sell their mineral rights at any time. Depending on the property and the technology available, the value of mineral rights varies. And mineral rights are taxable.

Mineral rights can be worth more than the surface land. While one large farm may sit atop a huge natural gas source, or a mountain ranch may abut a gold mine, other properties do not pan out so well. Mineral rights owners may negotiate percentages of royalty rates as the more valuable minerals are removed.

If you find you own mineral rights, do not be too quick to overvalue your prospects. Rather, engage a landman to assess the situation. Mineral rights on land may be separated from the surface rights in some way. For example, the previous owners may have temporarily leased mineral rights. A ranch broker also helps investors optimize available opportunities, outline risks, and help investors mitigate them.

Licenses, Easements

Selling mineral rights and access is somewhat complicated, especially when there are multiple owners involved. Be sure you have experts when it comes to allowing mining companies to explore the potential reserves on an investment property, farm, or ranch. A third party may be granted a license to extract and remove the reserves. A third party may also be given an easement to extract the minerals.

If you own, let’ say, a ranch in Colorado, and you have the deed, management will be easier if the deed says fee simple. Owners of our large farms and ranches who are approached by mining companies need complete information before responding. The resources from your land real estate agent will help guide you towards negotiating prices and fees.

Harrigan Land Company – Farm and Ranch Brokers

Talk to Broker Dave Harrigan and the team at Harrigan Land Company to learn details about farms and ranches for sale in CO, NM, WY, UT, and MT. Call 303-908-1101.